Discover how this Polish bank has used Wacom products to increase the efficiency and security of its customer service.

Financial Services

Big financial decisions

Powered by Wacom

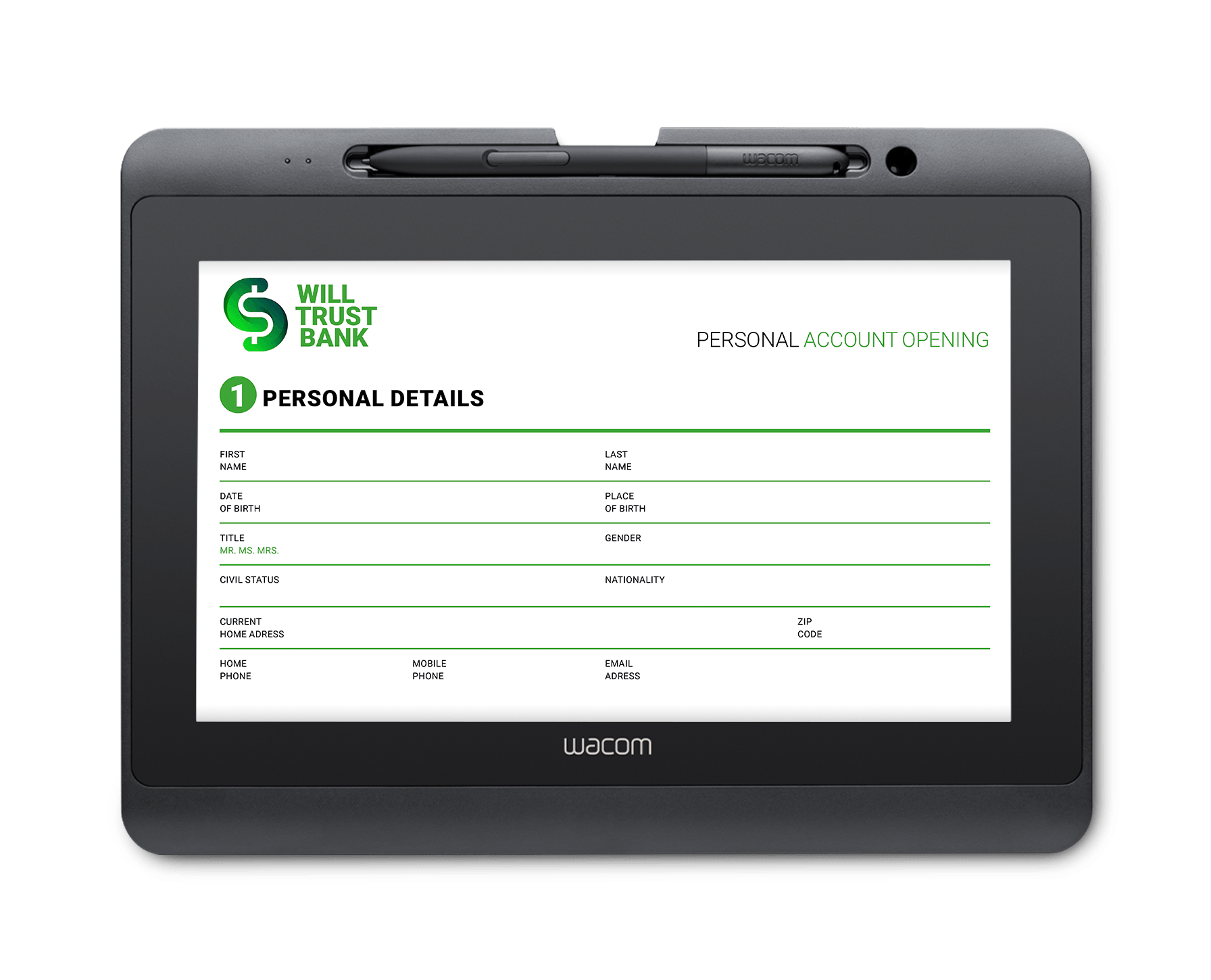

Financial Services providers use Wacom solutions to help secure legally-binding agreements from customers for everything from account opening, to credit agreements.

Supporting significant commitments

Modern banks, insurance firms, securities companies and other financial service providers need to put customers at ease when making important commitments such as mortgages, credit agreements, and loans.

But they also need to streamline their processes and eliminate paper-based workflows to accelerate revenue generation and minimize customer wait times.

How Wacom helps

Wacom solutions for financial services enable financial service providers to achieve these objectives in a number of ways. Firstly, document management becomes faster and more efficient through the instant digitization of forms, which also reduces paper waste and the costs of managing it.

Secondly, Wacom digital pen and ink technologies ensure a familiar handwritten signing and form-processing experience for financial services professionals and their customers. And the experience is improved thanks to the elimination of clumsy keyboard and mouse inputs that interrupt in-person interactions.

Financial Services Use Cases

Enable efficient branch modernization

Financial services providers want to streamline their processes. But they also want to retain the human touch that customers value when making important financial decisions in person. Wacom solutions enable this by:

- Accurately replicating traditional pen and paper signatures, with the added benefit of a completely digital process.

- Saving time and paper costs by eliminating the need to print, scan, and retrieve paper.

- Freeing staff to engage more directly with customers during the transaction.

Verification

Powered by Wacom

Signatures are still the most familiar way to make big financial commitments - but they need to be secure. Wacom solutions can help.

-

Overview

-

Preventing and identifying signature fraud

Financial services firms need to ensure customer agreements are legally binding, prevent imposters from attempting to commit fraud, and identify signature anomalies after the fact. So, how do you recognize someone trying to forge or disguise a signature in real time, or spot fake signatures amongst genuine ones?

Wacom Ink SDK for verification helps bank clerks confirm the identity of customers in real time. It also supports anti-fraud teams spot signature anomalies over time during their investigations.

Specifically, the SDK:

- Compares new or suspicious handwritten signatures with known genuine examples in real-time or as part of a forensic examination process.

- Provides an immediate acceptance or rejection notification.

- Is the most accurate, secure and cost-effective solution available.

- Does not store any signature data, eliminating compliance concerns.

“This solution has been extremely well received by users.”

Mrs Damjanovičeva, Executive Director, Retail banking and Micro-enterprises

Loan Origination

Powered by Wacom

In a digital world, customers expect to secure credit quickly. Wacom solutions accelerate the contracting process.

-

Overview

-

Case Study

-

Simplify the processing of complex financial agreements

For a more immersive and intuitive employee and customer experience when completing complex forms, Wacom solutions for financial services enable:

- Digital writing, annotating, marking up, and highlighting of loan applications or agreements using the pen directly on the screen, as on paper.

- Collaborative completion of forms or documents between employees and customers, including the signing ceremony.

- A streamlined, digital approval process with no paper required.

“Today, we have 20,000 clients using 1,700 displays in the bank’s branches.”

Tomasz Motyl, IT Systems & Innovations, Alior Bank